For Investors

Financial Information

For Investors

Financial Information

1st Quarter Results For The Financial Period Ended 31 October 2025

Revenue* (RM'000)

3,914,844

*Includes share of joint ventures' revenue

Profit before tax (RM'000) 282,340

Net Profit (RM'000) 215,126

Gamuda Reports 5% Earnings Rise on Strong Domestic Performance, Declares 5 Sen Dividend

Gamuda today posted a 5% rise in its quarterly earnings to RM215 million from last year’s RM205 million, primarily driven by robust contributions from domestic construction projects and the successful execution of quick-turnaround projects (QTP) in Vietnam.

The Group declared an interim dividend of 5 sen per share, unchanged from the same period last year.

Quarterly construction revenue was flat due to the delays in the awards of several new domestic contracts, while some Australian projects are near completion. The construction net profit rose 10% due to stronger earnings from ongoing domestic construction contracts.

Looking ahead, the Group anticipates that this year’s earnings performance will be driven mainly by newly awarded domestic construction projects, including the construction of several data centres and higher contributions from various property QTPs in Vietnam.

The Group's resilience is anchored by its construction orderbook balance of RM37 billion and unbilled property sales of RM8 billion.

Read the Bursa announcement: [LINK]

For any clarifications, please contact:

4th Quarter Report For The Financial Period Ended 31 July 2014

3rd Quarter Report For The Financial Period Ended 30 April 2014

2nd Quarter Report For The Financial Period Ended 31 January 2014

1st Quarter Report For The Financial Period Ended 31 October 2013

Gamuda Reports 5% Earnings Rise on Strong Domestic Performance, Declares 5 Sen Dividend

Gamuda Reports 5% Earnings Rise on Strong Domestic Performance, Declares 5 Sen Dividend

Gamuda today posted a 5% rise in its quarterly earnings to RM215 million from last year’s RM205 million, primarily driven by robust contributions from domestic construction projects and the successful execution of quick-turnaround projects (QTP) in Vietnam.

The Group declared an interim dividend of 5 sen per share, unchanged from the same period last year.

Quarterly construction revenue was flat due to the delays in the awards of several new domestic contracts, while some Australian projects are near completion. The construction net profit rose 10% due to stronger earnings from ongoing domestic construction contracts.

Looking ahead, the Group anticipates that this year’s earnings performance will be driven mainly by newly awarded domestic construction projects, including the construction of several data centres and higher contributions from various property QTPs in Vietnam.

The Group's resilience is anchored by its construction orderbook balance of RM37 billion and unbilled property sales of RM8 billion.

Read the Bursa announcement: [LINK]

For any clarifications, please contact:

Gamuda Posts Record-breaking Orderbook of RM38B as Earnings Reach RM1B

Gamuda Posts Record-breaking Orderbook of RM38B as Earnings Reach RM1B

Gamuda today announced that the Group has achieved a first, with year-to-date net profit climbing 10% to reach the RM1 billion mark. The regional engineering and property group also saw its revenue increase by 11% to a record-breaking RM16.4 billion.

This milestone is a result of its strong domestic construction projects, with an all-time-high construction orderbook balance of RM38 billion after recording RM25 billion job wins during the year. This unprecedented orderbook balance provides strong revenue visibility and positions the Group for sustained growth over the coming years.

Notably, domestic construction projects comprise 50% of the order book, with data centres contributing 10% of the total value, reflecting the group's focus on diversified infrastructure developments as overall construction margins improved.

Meanwhile, Gamuda Land, its property arm, reported sales of RM4.1 billion, a 19% decline due to Hanoi project approvals near the end of this financial year, with the related sales expected to be carried forward to the next financial year.

Gamuda reported a 22% increase in net profit to RM332 million for the fourth quarter ended 31 July 2025, compared with last year’s RM272 million as domestic construction earnings doubled and overseas property earnings jumped 68%.

Looking ahead, the group anticipates next year’s earnings performance will be driven by newly awarded domestic construction projects and higher contributions from various property QTPs (quick turnaround projects), especially Vietnam’s Eaton Park project.

The resilience of the Group is also underpinned by its record high unbilled property sales of RM8 billion. The Group’s gearing is at 53%, well below the self-imposed gearing limit of 70%.

Read the Bursa announcement: [LINK]

For any clarifications, please contact:

Gamuda Posts Stronger Q3FY25 Result with Domestic Construction Earnings Tripling

Gamuda Posts Stronger Q3FY25 Result with Domestic Construction Earnings Tripling

Rewards shareholders with an increased dividend of 10 sen, up from 8 sen

Gamuda today announced robust quarterly earnings that rose 5% to RM247 million. This is driven by strong performance in its domestic construction division, with earnings tripling to RM104 million compared to the corresponding quarter last year, which was RM39 million.

The Board of Directors has declared a second interim dividend of 5 sen per share, bringing the year-to-date dividend to 10 sen per share, representing a 25% increase from the previous year's 8 sen (adjusted following 1:1 bonus share issuance).

The Group's domestic operations have gained momentum, with its orderbook contributing 41% of the overall RM35 billion construction orderbook, representing a substantial portion of the overall performance (in comparison to 28% last year). Quarterly construction revenue and net profit rose 4% and 40% respectively.

Meanwhile, Gamuda's data centre investments are beginning to yield positive returns, contributing meaningfully to the Group's engineering division pre-tax earnings. This development marks a significant milestone for the Group's expansion strategy, positioning it well for the growing demand for digital infrastructure.

In terms of the year-to-date (Aug 2024 - Apr 2025) result, the Group's revenue increased by 14% to RM11.5 billion in comparison to RM10 billion last year. At the same time, net profit rose 5% to RM671 million. Its property sales grew 10% to RM2.6 billion compared with RM2.3 billion sold last year, primarily driven by several quick-turnaround projects (QTPs) in Vietnam.

The Group continues to maintain a healthy balance sheet with a comfortable net gearing ratio of 45%, which is well below its self-imposed gearing limit of 70%.

Read the Bursa announcement: [LINK]

For any clarifications, please contact:

Gamuda Breaks Construction Orderbook Record for 4 Consecutive Years, Q2FY25 Hits RM36 Billion

Gamuda Breaks Construction Orderbook Record for 4 Consecutive Years, Q2FY25 Hits RM36 Billion

Gamuda Berhad (Gamuda) has achieved an all-time high construction order book of RM36 billion in its second quarter of FY2025, ended 31 January 2025 - consistently breaking its own record for four consecutive years.

The Group's revenue and earnings are experiencing continued growth, primarily fuelled by stronger contributions from its domestic construction division. This growth is substantiated by the domestic orderbook's expansion from RM7 billion to RM14 billion over the past six months, now representing 40% of the total construction orderbook.

In a statement, Gamuda said the domestic orderbook is expected to expand next month with the imminent signing of several large domestic contracts; culminating in the growth of future margins and earnings of the construction division.

The Group's revenue increased by 32% to RM8.2 billion, whilst net profit rose 5% to RM424 million for the first half of this year.

In the first half of FY2025, Gamuda secured its highest annual new project portfolio totalling RM14.5 billion, comprising six significant project awards including three international ventures (Australia Boulder Creek Wind Farm, Australia Goulburn River Solar Farm, Taiwan Xizhi Donghu Mass Rapid Transit) and three domestic projects (Sabah Ulu Padas Hydroelectric Project, Penang LRT - Mutiara Line Phase 1 and Cyberjaya Data Centre). This demonstrates the Group's robust regional infrastructure capabilities to meet its target orderbook of RM40 billion to RM45 billion order book target by end-2025.

The Group's quarterly revenue rose to RM4 billion, up 19%, while its quarterly earnings rose to RM219 million, up 5%.

Its quarterly construction revenue and earnings rose 22% and 13% respectively. Meanwhile, for the property arm, quarterly property sales rose 56% to RM1.1 billion, compared with RM719 million in the previous comparative quarter, due to stronger sales from QTPs, especially Eaton Park in Vietnam.

Unbilled property sales of RM7.2 billion also underpin the Group's resilience. Meanwhile, it continues to maintain a healthy balance sheet with a comfortable net gearing ratio of 39%, which is well below its self-imposed gearing limit of 70%.

Read the Bursa announcement: [LINK]

For any clarifications, please contact:

Gamuda's Q1FY25 Orderbook Hit Record High RM30B, Net Earnings Increased to RM205M

Gamuda's Q1FY25 Orderbook Hit Record High RM30B, Net Earnings Increased to RM205M

Highlights:

Current Quarter (Q1: Aug 2024 - Oct 2024)

- The Group's construction order book reached an unprecedented RM30 billion, driving sustained quarterly revenue growth, which rose 47% to RM4.2 billion compared with RM2.8 billion in the previous comparative quarter.

- Quarterly net profit grew 5% to RM205 million compared with RM195 million in the same quarter the previous year.

- While construction earnings grew 20%, overall property earnings saw a 17% temporary decrease due to the completion of Vietnam's Celadon City at end of last year. Despite this, overseas property earnings are expected to pick up with varied quick-turnaround projects and comfortably offset the temporary dip in overall property earnings

- Quarterly construction revenue rose 38% due to higher earnings contribution from overseas projects, especially in Australia and domestic projects such as Penang reclamation.

Comparison with Immediate Preceding Quarter's Results

- The Group Q1FY25 earnings of RM205 million, a decrease of 25% compared with Q4FY24 earnings of RM272 million following the completion of Vietnam's Celadon City at the end of last year.

Other Highlights

- The Group's performance this year will be largely driven by overseas and domestic construction works, including several data centres and a higher contribution from various quick-turnaround projects (QTP).

- The Group's resilience is underpinned by its all-time-high construction orderbook of RM30 billion and unbilled property sales of RM6.9 billion.

- The Group has a healthy balance sheet with a comfortable net gearing of 39%, well below its self-imposed gearing limit of 70%.

For any clarifications, please contact:

Gamuda Rewards Shareholders with Bonus Issue. Record-Breaking Performance.

Gamuda Rewards Shareholders with Bonus Issue. Record-Breaking Performance.

Highlights:

Year To Date (August 2023 - July 2024)

- A year of milestones for Gamuda as the Group announces the following key

financial highlights:

- One-for-one bonus issue.

- Record-breaking construction orderbook (RM25 billion) and property sales (RM5 billion).

- Record-breaking revenue (RM15 billion - figure includes the share of joint venture companies' revenue) and core post-tax earnings (RM912 million).

- Bonus issue of new ordinary shares on the basis of 1 bonus share for every 1 existing ordinary share held on an entitlement date to be announced later.

- Gamuda has achieved record-breaking performance for the third consecutive year, propelled by exceptional growth in its construction orderbook and property sales.

- The Group reported annual revenue of RM15 billion, a 63% increase from last year's revenue, with overseas construction revenue tripling to RM9 billion from RM3.5 billion. The growth was anchored by the higher work progress of the Australian projects.

- Excluding the discontinued highway operations, core net earnings grew 12% to a record-breaking RM912 million from last year's RM815 million on the back of higher overseas construction earnings and stronger domestic property earnings and margins.

Current Quarter (Q4: May 2024 - July 2024)

- The Group's quarterly revenue grew 39% to RM4.8 billion (figure includes the share of joint venture companies' revenue) compared with RM3.4 billion in the previous comparative quarter.

- Quarterly net profit grew 8% to RM272 million compared with RM252 million in the previous comparative quarter.

Other Key Highlights

- The Group anticipates next year's performance will be driven mainly by overseas and domestic construction activities, including the construction of several data centres and higher contributions from the property division's various quick-turnaround projects (QTP).

- The Group's resilience is underpinned by its large construction order book of RM25 billion and unbilled property sales of RM7.7 billion.

- The Group has a healthy balance sheet with a comfortable net gearing of 39%, well below its self-imposed gearing limit of 70%.

Gamuda raises annual dividend by 33% to 16 sen, signals bullish growth prospects

Gamuda raises annual dividend by 33% to 16 sen, signals bullish growth prospects

Gamuda Berhad announced a significant increase in its annual dividend and strong financial results for the nine months ending 30 April 2024, underpinned by robust overseas growth and a positive outlook.

- Group revenue surged 73% to a record RM10 billion

- Core net profit up 14% to RM640 million, excluding highway earnings

- Gamuda Engineering's overseas revenue and net profit tripled

Key Highlights

- This year's 33% increase in the Group's annual dividend (from 12 cents to 16 cents per share) reflects confidence in the Group's robust outlook and sustainable growth potential.

- The Group's overseas accounts for 77% of overall group revenue (up from 52%) and 68% of overall group net profit (up from 48%).

- Gamuda Engineering's Australian projects drive the growth in overseas earnings, tripling revenue and net profit. Overseas growth comfortably offsets the temporary dip in domestic earnings, which was held back by the delay in regulatory approvals for several domestic projects, such as Penang Light Rail Transit (LRT) and Ulu Padas Hydroelectric Dam in Sabah.

- The Group's quarterly revenue ended April 2024 rose 82% to RM3.8 billion from last year's quarterly revenue, while quarterly net profit rose 6% to RM236 million.

- Gamuda Land's revenue and net profit grew 47% and 31%, respectively, driven by strong earnings and margins from domestic projects.

- The Group's resilience is underpinned by its large construction orderbook of RM24 billion and unbilled property sales of RM6.7 billion.

- The Group has a healthy balance sheet with a comfortable net gearing of 35%, well below its self-imposed gearing limit of 70%.

Gamuda's first half revenue doubles to RM6.2B, earnings rose 19% to RM404M

Gamuda's first half revenue doubles to RM6.2B, earnings rose 19% to RM404M

Overseas projects quadruple, offset domestic revenue decline

Half Year To Date (August 2023 - January 2024)

- The Group reported nearly doubled revenue of RM6.2 billion compared to last year's RM3.7 billion, while its net profit saw an increase of 19% to RM404 million. The stronger performance is anchored by overseas revenue and net profit surges due to the pick up in progress of overseas projects especially in Australia.

- The Group's overseas engineering arm revenue quadrupled to RM4 billion from last year's RM1 billion, while the net profit quadrupled to RM138 million compared to RM33 million last year.

- Property division's overall revenue and net profit grew 29% and 46%, respectively, bolstered by stronger overseas and domestic projects.

Current 2nd Quarter (November 2023 - January 2024)

- The Group's quarterly revenue rose 53% to RM3.4 billion compared with RM2.2 billion last year. Meanwhile, quarterly net profit rose 7% to RM209 million.

- On the overseas front, the Group's engineering arm's quarterly revenue tripled to RM2.1 billion (from last quarter RM662 million), while net profit more than doubled to RM72 million (from last quarter RM34 million), with Australia projects progressing well.

Comparison To Immediate Preceding Quarter

- It's an increase of 7% as the Group Q2FY24 earnings saw RM209 million, compared to the immediate preceding quarter (Q1FY24) earnings of RM195 million.

Other key highlights

- The Group's resilience is underpinned by its large construction orderbook of RM24 billion and unbilled property sales of RM6.7 billion.

- The Group has a healthy balance sheet with a comfortable net gearing of 29%, well below its self-imposed gearing limit of 70%.

Resilience and growth: Gamuda's Q1FY24 reflects a thriving overseas portfolio

Resilience and growth: Gamuda's Q1FY24 reflects a thriving overseas portfolio

Gamuda announced impressive results for Q1FY24, with its core earnings rising 35% to RM195 million in the current quarter as revenue doubled on the back of higher construction from overseas projects.

In the absence of highway earnings, both of the Group's core construction and property segments demonstrate an upswing, indicating a resilient performance in contrast to the RM145 million earnings recorded in Q1FY23.

This substantial growth is attributed to a doubled revenue stream, primarily fuelled by the heightened contributions from its overseas projects.

Meanwhile, the Group's total revenue scaled new heights to RM2.8 billion from RM1.4 billion in the previous year, as overseas revenue takes centre stage, tripling to RM2.1 billion.

Looking ahead, Gamuda said it anticipates this year's performance to be driven by the continuous momentum of overseas construction activities in Australia and Taiwan, coupled with the full-year impact of the recently acquired Australian transport projects business of Downer Transports Projects (acquisition finalised on 20 June 2023).

Additionally, buoyant property sales, including contributions from newly launched quick-turnaround projects (QTP) in the property division, are poised to be key growth drivers.

The resilience of the Group is underpinned by a robust construction order book tallying RM26 billion and unbilled property sales amounting to RM6.7 billion.

On top of that, the Group maintains a healthy balance sheet with a comfortable net gearing of 25%, well below its self-imposed gearing limit of 70%.

Gamuda remains optimistic about its trajectory, leveraging its track record and strategic initiatives to navigate the dynamic landscape of construction and property development.

4th Quarter Results For The Financial Period Ended 31 July 2023

Gamuda posts all-time-high construction orderbook, property sales, revenue and earnings

Highlights:

Year To Date (August 2022 - July 2023)

- The Group reported annual revenue of RM9.1 billion, a 41% increase from last year's revenue, with overseas revenue doubling to RM4.6 billion from RM2.0 billion. This is anchored by a fourfold increase in overseas construction revenue to a record RM3.5 billion.

- The Group's pre-tax earnings crossed the RM2 billion mark for the first time following last year's record pre-tax earnings of RM1 billion. Excluding the exceptional cash gain of RM1 billion on the divestment of highways and completion of MRT Line 2, core post-tax earnings grew 7% to a record-breaking RM860 million this year from last year's record of RM806 million on the back of higher overseas construction earnings.

- Construction order book hit a record high of RM21 billion, and property sales surged to RM4.1 billion, setting new records.

Current 4th Quarter (May 2023 - July 2023)

- The Group's quarterly revenue grew 50% to RM3.3 billion compared with RM2.2 billion in the previous comparative quarter as work progress in Australia and Taiwan picked up pace.

- Meanwhile, quarterly core earnings is RM252 million, similar to last year's comparative quarter earnings of RM255 million.

Other Key Highlights

- The Group anticipates a significant uptick in activities next year, driven by overseas construction businesses including the full year contribution from the newly acquired Australian transport business of Downer Transports Projects and property sales including higher contribution from newly launched quick-turnaround-projects (QTPs).

- The resilience of the Group is underpinned by its large construction orderbook of RM21 billion, including a RM4.4 billion orderbook from the acquisition of Downer Transport Projects in Australia and unbilled property sales of RM6.7 billion.

- The Group has a healthy balance sheet with a comfortable net gearing of 25%, well below its self-imposed gearing limit of 70%.

3rd Quarter Results For The Financial Period Ended 30 April 2023

Gamuda's overseas revenue triples as overseas construction earnings replaces highway earnings

Highlights:

Year To Date (August 2022 - April 2023)

- Gamuda attained all-time-high earnings at RM1.6 billion for the year's first nine months.

- Excluding the one-off cash gain of RM1 billion on highway sale, core earnings ending 30 April 2023 rose 10% to RM608 million, compared with last year's earnings of RM551 million. Its stronger overseas construction earnings replaced highways earnings post-highway sale.

- The Group's nine-month revenue stood at RM5.8 billion, a 37% jump compared to RM4.2 billion from the previous year's revenue, as its overseas revenue tripled.

- The surge is due to increased overseas construction revenue to RM2.1 billion compared with the previous year's revenue of RM333 million as Australia and Taiwan projects ramped up work progress.

Current Quarter (February 2023 - April 2023)

- The Group's quarterly core earnings increased 1% to RM223 million compared with RM221 million in the previous year's quarterly earnings as overseas construction earnings replaced highway earnings.

- Meanwhile, quarterly revenue saw an increase of 60% to RM2.1 billion from last year's comparative quarter revenue of RM1.3 billion.

Other key highlights

- The resilience of the Group is underpinned by its large construction orderbook of RM20 billion, which includes the AUD$2 billion orderbook boost from the imminent completion of the Downer Transport Projects acquisition in Australia. In addition, the Group has RM5.7 billion of unbilled property sales.

- The Group has a healthy balance sheet with almost zero net gearing.

2nd Quarter Results For The Financial Period Ended 31 January 2023

Gamuda's first half-year core earnings rose 17%, overseas earnings surged as construction and property replaced highway earnings

Highlights:

Year To Date (August 2022 - January 2023)

- Gamuda's net profit for the first half ended Jan 31, 2023 (2QFY23) rose more than three times to RM1.4 billion from RM329 million in 2QFY22, mainly from the RM1 billion one-off cash gain on divestment of its four highways.

- Excluding the one-off divestment gain, the Group's core earnings for the first half ended Jan 31, 2023, rose 17% to RM385 million, compared with last year's first-half earnings of RM329 million as construction and property earnings replaced highway earnings. Overseas earnings, mainly from its Australia and Vietnam projects, surged to contribute 38% of overall core earnings compared to 18% previously.

- Group's half-year revenue stood at RM3.7 billion, a 26% jump compared to RM2.9 billion from the previous half-year revenue.

Current Quarter (November 2022 - January 2023)

- The Group's quarterly core earnings increased 10% to RM195 million compared with RM177 million in the previous year's quarterly earnings as stronger construction and property earnings replaced highway earnings while overseas earnings tripled.

- Meanwhile, quarterly revenue saw an increase of 32% to RM2.2 billion from last year's comparative quarter of RM1.7 billion.

Other key highlights

- The resilience of the Group is underpinned by its large construction orderbook of nearly RM21 billion, which includes the AUD2 billion orderbook boost from the imminent completion of the Downer Transport Projects acquisition in Australia. In addition, the Group has RM5.4 billion of unbilled property sales.

- The Group has a strong balance sheet with almost zero net gearing.

1st Quarter Results For The Financial Period Ended 31 October 2022

Gamuda posts new record high quarterly earnings of RM1.2 billion as overseas earnings grows 2.5X

Highlights:

Current Quarter (August 2022 - October 2022)

- Gamuda Berhad posted all-time-high earnings of RM1.2 billion for the first quarter of FY23 including a one-off gain of RM1 billion on the divestment of the four highways.

- Excluding the one-off cash gain, the Group's core quarterly earnings rose 25% to RM190 million, from RM152 million in last year's quarterly earnings. This was attributed to stronger earnings from all divisions as overseas earnings grew 2.5x to contribute 25% of core earnings compared to 12% previously.

- Group's quarterly revenue stood at RM1.5 billion, a 19% jump compared to RM1.3 billion from last year's comparative quarter as overseas revenue quadrupled.

Other Key Highlights

- The resilience of the Group is underpinned by its large construction orderbook of nearly RM15 billion, among which will be pick up in its overseas projects' work progress like the Sydney Metro West - Western Tunnelling Package and Coffs Harbour Bypass, both in Australia. Works for the MRT Putrajaya Line are also to complete soon. In addition, the Group has nearly RM6 billion of unbilled property sales.

- The Group has a healthy balance sheet with a net cash surplus position following the divestment of its highways.

4th Quarter Results For The Financial Period Ended 31 July 2022

Gamuda net profit rocketed to an all-time high of RM806 million, expanding regional footprint

Highlights:

Year To Date (August 2021 - July 2022)

- Gamuda's profit before tax (PBT) crossed the RM1 billion mark for the first time as it posted a record-breaking net profit of RM806 million; a 37% increase compared with RM588 million earned last year on the back of stronger construction and property earnings.

- The Group's overseas earnings tripled to RM292 million compared with last year's RM98 million. This comes following the Group's strategic move to expand its overseas market footprint in the engineering and property sectors.

- The property division delivered all-time-high performances in revenue and earnings, with record-high sales of RM4 billion, compared with last year's RM2.9 billion sales.

- Gamuda Engineering's net profit also achieved an all-time high of RM343 million as work progress on all fronts picked up the pace.

Current Quarter (May 2022 - July 2022)

- The Group's quarterly earnings jumped 20% to RM255 million compared with RM213 million in the previous comparative quarter as property and construction divisions reported improved earnings.

- Meanwhile, quarterly revenue saw an increase of 112% to RM2.2 billion from last year's comparative quarter of RM1 billion.

Other key highlights

- The resilience of the Group is underpinned by its large construction orderbook of nearly RM14 billion, among which are its overseas engineering projects like the Sydney Metro West - Western Tunnelling Package and Coffs Harbour Bypass, both in Australia. In addition to unbilled property sales of RM6.2 billion.

- The Group has a strong balance sheet with a low gearing of 0.1 times which will turn net cash positive upon completion of its highway sale.

3rd Quarter Results For The Financial Period Ended 30 April 2022

Gamuda's nine-month earnings surge 47% due to stronger overseas earnings

Highlights:

Year To Date (August 2021 - April 2022)

- The Group's nine-month earnings rose 47% to RM551 million in comparison to RM375 million earned in the same period last year on the back of higher property and construction earnings as work on all fronts picked up pace. Overseas earnings tripled that of last year.

- Property sales jump 23%, with RM2.7 billion worth of properties sold in the first nine months of this year, compared to RM2.2 billion in the same period last year. Overseas projects remain our biggest sales contributor, especially Vietnam and Singapore markets which contributed 53% of the total property sales whilst sales for the local projects doubled up.

- Gamuda Land is on track to achieve its full year sales target of RM4 billion which is 38% more than last year's RM2.9 billion sales.

- The Group posted revenue of RM4.2 billion, an increase of 7% compared with RM4.0 billion in the same period last year.

Current Quarter (February 2022 - April 2022)

- The Group's quarterly earnings surged 56% to RM221 million compared with RM142 million in the previous corresponding quarter as property and construction divisions reported improved earnings.

- Meanwhile, quarterly revenue saw an increase of 21% to RM1.3 billion from last year's comparative quarter of RM1.1 billion.

Other key highlights

- The resilience of the Group is underpinned by its strong construction order book which increased to RM12.4 billion following its recent second infrastructure win in Australia the Coffs Harbour Bypass Project at AUD$1.35 billion;

- Additionally, the Group has an unbilled property sale that sum up to RM5.4 billion.

- The Group has a healthy balance sheet with a low gearing of 0.1 times and a strong cash position.

2nd Quarter Results For The Financial Period Ended 31 January 2022

Gamuda's current half-year earnings rose 41%, and property sales jumped 27%

Highlights:

Year To Date (August 2021 - January 2022)

- With the reopening of economic sectors and a relative return to normalcy, the Group's current half-year earnings saw a 41% increase to RM329 million in comparison to RM234 million earned in the first half of last year as construction and property earnings surged on the back of a pick-up in construction activities and higher contribution from overseas property projects.

- Property sales increased by 27%, with RM1.9 billion worth of properties sold in the first half of this year, compared to RM1.5 billion in the same period last year. Overseas projects remain our biggest sales contributor, especially Vietnam and Singapore markets which contributed 60% of the total property sales whilst sales for the local projects doubled up.

- Gamuda Land is on track to achieve its full year sales target of RM4 billion which is 38% more than last year's RM2.9 billion sales.

Current Quarter (November 2021 - January 2022)

- The Group's quarterly earnings rose 44% to RM177 million compared with RM123 million in the previous corresponding quarter as construction and property divisions reported improved earnings as works on all fronts picked up pace.

Other key highlights

- The resilience of the Group is underpinned by its strong construction order book which tripled to RM10.4 billion following the recent two overseas wins : Sydney Metro West - Western Tunnelling Package (WTP) at AUD$2.16 billion; and Singapore Defu Station and Tunnels at SGD$467 million.

- Additionally, the Group has an unbilled property sales that sum up to RM5.2 billion.

- The Group has a healthy balance sheet with a low gearing of 0.2 times and a solid cash position.

1st Quarter Results For The Financial Period Ended 31 October 2021

Gamuda's first-quarter earnings rose 38% due to a proven & recognised COVID-19 management ecosystem

Highlights:

Current Quarter (Aug 21 - Oct 21)

- Gamuda Berhad's earnings rose 38% to RM152 million for the first quarter of its financial year ended October 31, 2021, from RM110 million in previous corresponding quarter. This was attributed to stronger earnings from all divisions as works on all fronts continued to pick up pace due to the Group's unique "new normal" COVID-19 management ecosystem.

- Quarterly revenue stood at RM1.3 billion, 17% lower compared to RM1.5 billion in same period under review.

- Property sales improved 25% with RM838 million worth of properties sold in the first quarter of this financial year, compared to RM673 million in the same period last year. Overseas sales continued to spearhead the Group's property divisions, contributing two-thirds of overall sales. While at the local front, Gamuda Gardens and Gamuda Cove sales have doubled in volume.

Comparison with immediate Preceding Quarter's results

- Quarterly net profit decreased 29% to RM152 million, compared to a net profit of RM214 million in the immediate preceding quarter. This was due to lower overseas earnings, especially as Vietnam continued to be in lockdown this quarter.

Unique and Proven COVID-19 Management System

The Group's COVID-19 solid measures have helped the continuity of its business-critical operations. Through these efforts, we have succeeded in keeping the infectivity rate low at our construction sites (currently at <0.1%) with minimal work disruption.

The Group's rigorous "COVID-ready" ecosystem is one of the significant attributes that contributed to the Group's triple international award wins recently for its work on the MRT Putrajaya Line project:

- Major Project of the Year, International Tunnelling Association (ITA) Awards 2021

- Tunnelling Project of the Year, New Civil Engineer Tunnelling Festival 2021

- International Project of the Year, Ground Engineering Awards 2021

Other key highlights

The ongoing risks to the country's economic and fiscal outlook posed by the progression of the COVID-19 pandemic and uncertainties surrounding the Delta and now Omicron variants have dampened economic activities. Despite that, the Group's unique "COVID-ready" ecosystem for managing endemic risks will continue to support the business robustly:

- The resilience of the Group is underpinned by its construction order book of RM3.8 billion and unbilled property sales totalling RM4.9 billion.

- The Group has a healthy balance sheet with low gearing of 0.2 times and a strong cash position.

- The Group resumed dividend payments as the Board of Directors has declared an interim dividend of 6 sen per ordinary share in respect of financial year ending 31 July 2022, in which the payment date will be announced later. No interim dividend was declared in the previous corresponding period.

4th Quarter Results For The Financial Period Ended 31 July 2021

Gamuda's full year earnings rose 56% due to stronger construction and property earnings, and rigorous COVID-19 control measures

Highlights:

Year To Date (Aug 2020 - July 2021)

The Group's earnings grew at 56% year-to-year to RM588.3 million, compared with

previous year's RM376.5 million due to stronger construction and property

earnings as works picked up pace given rigorous COVID-19 measures adopted by the

Group.

The Group posted a full year revenue of RM5.0 billion. The construction division delivered a solid earnings performance, with construction earnings jumped 46% to RM253.0 million due to higher earnings contribution from MRT Putrajaya Line (with its first phase opening by mid-November 2021).

Property sales jumped 32% more than last year as overseas sales (Vietnam and Singapore) contributed two-thirds of the group sales. Sold RM2.9 billion worth of properties this year.

Current Quarter (May 21 - July 21)

The Group posted quarterly earnings of RM214.1 million compared with last year's

quarterly loss of RM12.5million.

Comparison with immediate Preceding Quarter's results

The Group posted quarterly earnings of net profit of RM214.1 million, an

increase of 51% compared to the immediate preceding quarter net profit of

RM141.8 million, due to stronger construction and property earnings.

Other highlights

With strong COVID-19 measures in place which has helped the continuity of its

business-critical operations, it is anticipated that next year's performance

will be smooth sailing and driven by:

- Overseas and home ground property sales.

- The continued progress of MRT Putrajaya Line gearing up for Phase 2 completion.

- The resilience of the Group is underpinned by its construction order book of RM4.5 billion and unbilled property sales totalling RM4.6 billion which see it through the next two years.

- The Group has a healthy balance sheet with low gearing of 0.2 times and a strong cash position.

Gamuda Australia Outlook

We are actively bidding for the multibillion worth of projects in Australia. We

have been shortlisted for these tenders:

- AUD2.5 billion (RM7.5 billion) Sydney Metro West - Western Tunnelling Package. Package outcome is extended to Q1, 2022.

- AUD2.5 billion (RM7.5 billion) Western Sydney Airport Metro line (Station Box and Tunnelling package); outcome expected Dec 2021.

3rd Quarter Results For The Financial Period Ended 30 April 2021

Profits back to pre-MCO level, sharp property segment recovery

The Group's net profit more than tripled to RM141.83 million, led by stronger profitability of construction, property and toll concession businesses.

Quarterly revenue rose by 10% from RM1 billion to RM1.1 billion. The biggest revenue contributor was the construction segment at RM507.3 million. The revenue from the property business has doubled to RM468.4 million.

Property sales jumped by 83% with overseas sales, especially Vietnam and Singapore contributing two-thirds of overall sales. The property division sold RM2.2 billion worth of properties in the first three quarters of this year compared with RM1.2bil in the same period last year.

Gamuda Australia is actively bidding for projects and has been shortlisted for these tenders:

- AUD5 billion (RM15 billion) Sydney Metro West Project (Central and West packages); SMW Central package outcome expected Q3, 2021, while SMW West package outcome is expected in Q4, 2021.

- AUD2.5 billion (RM7.5 billion) Western Sydney Airport Metro line (Station Box and Tunnelling package); outcome expected Q4, 2021.

The Group's resilience will be underpinned by its construction order book of RM4.9 billion and unbilled property sales totalling RM4 billion, which will last through the next two years. It has a healthy balance sheet with a gearing level of below 0.3 times.

Gamuda Green Plan, a comprehensive road map charts tangible goals based on ESG dimensions set for the next 5 years, with an extended view to 2030 and beyond. The Group is committing to circular construction with specific steps to reduce corporate direct and indirect greenhouse gas emission intensity by 30% in 2025 and by 45% in 2030.

2nd Quarter Results For The Financial Period Ended 31 January 2021

Ongoing construction jobs, MRT2 to drive growth

The Group's financial performance continued to be resilient despite the reimposition of movement restrictions in most parts of Malaysia. Net profit declined by 30% to RM123.12 million from RM175.17 million a year earlier due to the pandemic effects. Quarterly revenue fell 38% to RM1.38 billion from RM2.22 billion in the previous year's corresponding quarter (This is based on Group revenue including share of joint venture companies' revenue).

The pace of construction and property projects was returning to pre-movement restriction level due to the Group's rigorous Covid-19 measures on all work fronts. Moving forward, the resilience of the group is underpinned by its construction order book of RM5.5 billion* and unbilled property sales totalling RM3.6 billion which will see it through the next two years.

The Group has a healthy balance sheet with a prudent gearing of 0.3 times. The Company's 60%-owned SRS Consortium Sdn Bhd has on 25 March 2021 entered into a 70:30 Project Development Joint Venture with Penang State Government for the development of Island A of the Penang South Islands.

* excluding Penang reclamation works which will be determined after verification by an Independent Consulting Engineer appointed by the Penang State Government

1st Quarter Results For The Financial Period Ended 31 October 2020

Gamuda aims for RM10b new order book

The Group's financial performance continues to be resilient despite the re-imposition of conditional movement control order in most parts of Malaysia at the tail-end of this quarter.

The Group recorded a net profit of RM109.28 million for the first quarter of its financial year ended October 31, 2020.

This is 37% lower compared with the previous corresponding quarter's pre Covid-19 net profit of RM173.62 million.

Revenue was RM1.5 billion, 16% lower than RM1.8 billion recorded in the same quarter a year ago. Overseas sales, especially Vietnam and Singapore, continued to spearhead the group's property division; contributing two-thirds of overall sales.

The construction order book is at RM6.1 billion and unbilled property sales of RM3.2 billion, for the next two years.

The Group has a balance sheet with a gearing of 0.3 times.

Works at all construction and property projects have gradually picked up pace while traffic plying the expressways were returning to pre-movement restrictions level.

The Group anticipates performance of its current financial year to be driven by overseas property sales in Vietnam and Singapore and continued progress of the MRT Putrajaya Line.

New orderbook is premised on two major job prospects - Penang South Islands and Australia, amounting to RM10 billion.

Financial Highlights

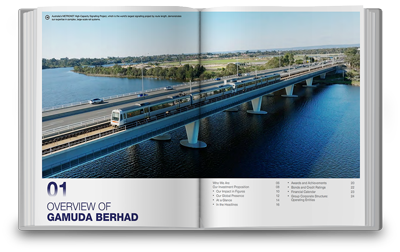

Integrated/Annual Report

2025 Integrated Report

Financial Calendar

Record Date: 05 Feb 2026

Payable Date: 04 Mar 2026

Record Date: 13 Aug 2025

Payable Date: 10 Sep 2025

Record Date: 10 Feb 2025

Payable Date: 10 Mar 2025

Record Date: 09 Aug 2024

Payable Date: 05 Sep 2024

Record Date: 31 Jan 2024

Payable Date: 28 Feb 2024

Record Date: 04 Aug 2023

Payable Date: 01 Sep 2023

Record Date: 02 Feb 2023

Payable Date: 02 Mar 2023

Record Date: 14 Dec 2022

Payable Date: 23 Dec 2022

Record Date: 05 Aug 2022

Payable Date: 02 Sep 2022

Record Date: 10 Feb 2022

Payable Date: 08 Mar 2022